|

As of May, Quids in! Money Guidance, delivered by Clean Slate Training & Employment, embarks on a two year partnership with Centre for Sustainable Energy (CSE) in Bath & North East Somerset (B&NES). Quids in! joins CSE’s WHAM project in B&NES alongside partners We Care Home Improvements and Citizens Advice B&NES. Quids in! will offer remote support, ranging from 2-3 sessions or 5-6 sessions depending on the client's needs, to those referred directly through CSE/WHAM or from WHAM partners via CSE. WHAM (Warmer Homes, Advice & Money), CSE’s partnership project, offers support with energy, money, benefits, and household repairs to vulnerable residents in Bristol and North Somerset. Two-year funding from Wales & West Utilities makes it possible for WHAM to expand their program into B&NES with Quids in! and two additional partners in the area. Quids in! Money Guidance offers free drop-in services, workshops and online support to low income individuals. Quids in! also publishes a print and digital magazine, range of guides, personal finance emails and interactive web content. The partnership aims to tackle fuel poverty in the region while equipping people with the resources and tools to prevent debt and maintain a safe and happy home. “We are really thrilled to become the latest partners in the fantastic B&NES WHAM Project,” says Anna Dietrich, Clean Slate’s Regional Lead, West of England. “CSE helps people save money by increasing energy efficiency in their homes, which is a perfect fit alongside our Quids in! money guidance service. Together we will be able to support low income households across B&NES to save money and live more comfortably in their homes. Funding partnership projects like this are a great example that show how forward thinking of funders can make a huge difference not only for low income households but also recognising and strengthening those strong relationships within the third sector.” CSE will be offering support around warmer homes such as explaining bills, contacting energy providers on behalf of clients settling debts, energy efficiency support; We Care Home improvements will offer small handyman jobs like putting up curtain poles, applying for grants; CA B&NES will offer debt and benefit support; and, Quids in! will provide coaching to improve financial capability and wellbeing. In the last financial year, Quids in! helped over 1000 clients gain a total of £660,400 in financial gains with almost a third of the gains coming from benefits, energy savings and vouchers, and household repairs. The project is currently funded until December 2025. Clean Slate Training & Employment CIC is a not-for-profit organisation helping people on low incomes to become better off. We do this by helping people in financial hardship to re-think how they might manage their money, find work or better work, and get online.

Quids in! is involved in an exciting programme that's aiming to improve the health of people on low incomes by easing money concerns Residents struggling with money and their health are benefitting from a new money guidance service in South London.

Health and care partners have linked up with Quids in! Money Guidance to help residents increase their incomes and reduce their spending. Four in 10 Londoners are living below the Minimum Income Standard, putting them at a higher risk for poverty-related health issues such as chronic illnesses, mental health issues, and reduced life expectancy. Funded by the Mayor of London and supported by Thrive LDN, London’s public mental health partnership, the pilot programme launched in Lambeth, Southwark and Lewisham on 5 February. A targeted number of residents are being offered a money health check and guidance to help reduce the impact of financial worries on their health. The service is phone-based to reduce travel costs and fit around participants’ other commitments. Space to get well The Quids in! Money Guidance offer includes magazines and guides, a website full of news and money-saving tips, a monthly email covering the latest news on benefits, employment and bargains, as well as a face-to-face support service in some areas. Jeff Mitchell, managing director of Clean Slate Training and Employment, which runs Quids in!, said: “When every waking thought is about keeping the children fed, it’s hard for people to think enough about their health. "Quids in! coaches give people time to pause, take stock, explore their options and shore up their finances. Once they have their heads above water financially, they have both the means and the confidence to focus on getting well.” During the pandemic, a team of advisors took to the phones to conduct the Quids in! money health check. Some 3,000 social tenants, benefit claimants and long-term unemployed people took part. In one service, 98 per cent of participants were found to be disabled or have emotional or recognised mental health support needs. In its 2023 Cost of Living Survey, Quids in! found that on account of money worries 73 per cent of social renters on the lowest incomes had felt frightened, anxious or depressed; 64 per cent had skipped meals; 75 per cent were turning off the heating despite being cold; and, 36 per cent had become physically ill. In 2023, its money guidance programmes helped people access average financial gains of £1,244. Money worries and health The links between living on a low income and poorer health outcomes are well documented. But on top of this, Quids in! is also well aware of how simply worrying about money can impact on health. Joanne, who came to Quids in! before this pilot started, had been struggling with her mental health. She had just £10 a month to spend on food, and dinner some nights was half a Pot Noodle. We walked her through a money health check and she said she had a big bag of unopened post. We supported her to open the mail and discovered she’d been overpaying housing costs and had an unused gym membership. And there was a cheque from the Widow’s Benevolent Fund. Not only did she have a windfall of £4,700, from there on she was £2,200 a year better off. She was able to eat and an emotional burden was lifted. She was ready to access debt support and felt strong enough to begin thinking about a return to work. Joined-up thinking Thrive LDN director, Dan Barrett, said: "We recognise the profound impact of financial struggles on mental health. "We are thrilled to partner with Clean Slate on this pilot to support people on lower incomes and assist those individuals through an evidence-based money guidance programme. "By exploring and educating on health and wellbeing indicators, this initiative marks a crucial step towards an integrated approach to tackling health inequalities and creating tailored solutions for those who need it most.” Clean Slate believes non-medical services, such as Quids in! Money Guidance, should be considered part of a broad public health system, providing holistic support to communities to help themselves be better off. Main image: Frankie Stone Northern Ireland Housing Executive teams up with magazine to deliver cost-of-living support17/1/2023

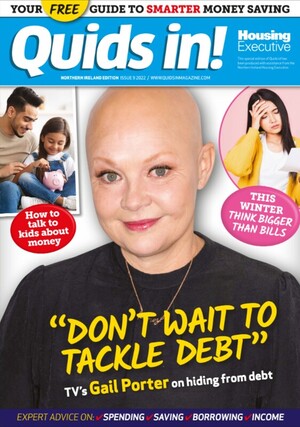

85,000 social housing tenants will receive a special edition of Quids in! magazine with advice on saving energy, making the most of tight budgets and managing money during these unprecedented times.

Hundreds of social landlords have now purchased the magazine in bulk, distributing them free to social housing tenants. Over 240,000 Quids in! magazines, guides and e-newsletters have gone out to people on low incomes across the UK in the last 12 months alone.

Jennifer Hawthorne, Director of Housing, Northern Ireland Housing Executive said: “We work throughout the year to support our tenants with advice and information about the issues that affect them most. Over the last six months we have focused on the cost-of-living crisis and provided a bespoke advice centre on our website which tenants can access 24/7. “Our annual tenant magazine, Streets Ahead, which is delivered directly to the homes of our tenants, also includes lots of information about the services and support they can access for help and advice. Quids in! provides us with a further opportunity to share important information with our tenants about managing finances and meeting the challenges of the cost-of-living crisis." Jeff Mitchell, Founder and Managing Director of Quids in! said: “Times are tighter than they’ve ever been. It’s good to make energy savings but, this year, we’ll need to think bigger than bills by looking at our finances in the round. This means using a budget planner to check our outgoings are not more than our income, using a benefits calculator to check we are claiming all we’re entitled to and getting savvy online to make the most of all the savings there. For some of us, despite our best efforts, this won’t be enough and that’s when it’s time to ask for help. There’s no shame in it - we all struggle at times.” Clean Slate has triumphed at the New Statesman Positive Impact Awards after helping 2,000 people on low incomes save an average £1,000 by rethinking their finances - that’s £2 million of financial gains shared between them. Bath-based Clean Slate Training and Employment has won a Positive Impact in Finance Award at the inaugural New Statesman Positive Impact Awards, held at Savoy Place in London on 6th December. With big names like Martin Lewis winning in other categories and up against household names like Triodos Bank and Legal and General, the judges were impressed by Clean Slate’s innovative approach to supporting people to improve their financial resilience.  *Image is copyright to The New Statesman Positive Impact Awards. From left to right: Emma Kernahan - Head of Programmes, Jeff Mitchell - Founder and Director of Clean Slate and Quids in!, Lisa Woodman - Head of Business Development, Naomi Contopoulos - Communications Manager. Clean Slate helps people on a low income to improve their finances via money guidance, employment and digital skills. Quids in! is their publishing and money skills initiative. A quiz in the company’s Quids in! magazine became the framework for delivering money guidance when all support had to be delivered remotely during the pandemic. The Future-Proof Finance Quiz asks 25, simple, yes/no questions. It looks at income and expenditure, but also at attitudes and habits. For clients in crisis, the simple approach allows them to relax and build trust. Soon, they are able to experience ‘quick wins.’ The quiz was developed in partnership with Mastercard and Good Things Foundation as part of the Nobody in the Dark campaign to address collectively financial and digital exclusion, with the steps of the quiz increasing client’s digital and financial confidence. The framework allows Support Workers to record financial gains next to actions. This might be people accessing benefits they are entitled to, changing their shopping habits or getting into work for example and 74.51% of clients say they now think carefully about their finances. On the question ‘Could you manage meals if your income stopped or changed for a few weeks’ only 16.9% of clients answered ‘yes’ the first time they took the quiz, jumping to 89.9% after receiving support. Clean Slate runs regular drop-ins in the West of England where people who are worried about money can come for a chat or, for those who prefer, Clean Slate is able to support people over the phone. The quiz is offered free for anyone struggling with their money and can be found on the Quids in! website. Jeff Mitchell, Founder and Director of Clean Slate and Quids in!, said: “Extreme financial crises often go hand-in-hand with mental health and even physical health crises - it’s an extreme stress response. We believe it makes sense to intervene before things reach this point. In a cost-of-living crisis, money guidance and financial resilience support is needed more than ever. We are ready to welcome people who need our help and we are also looking to expand our highly scalable model via a network of partners.” Ahead of the New Statesman Positive Impact Awards, Clean Slate Founder and Director, Jeff Mitchell, writes that in many ways, we are already winners Wish Us Luck… (And No, Not With The Football)

Tonight is the inaugural New Statesman Positive Impact Awards bash. Clean Slate is nominated for its Positive Impact in Finance trophy. You don’t need to wish us luck as, in many ways, we’re already winners… of recognition that our small team will be represented up alongside corporates, institutions, tech start-ups and long-established change-makers. We share our category with banking App Starling, ethical financiers Triodos and health research charity the Wellcome Trust. Just to rub shoulders here is a testament to ways we made a small dent on poverty during the pandemic emergency. In 2021 alone, we directly helped 2,000 people struggling to keep their heads above water financially. They shared about £2,000,000 of financial gains as a result. In many ways, this nomination belongs to them too because we try less to fix things for people but to give them the means to sort things for themselves. We also worked with 20 community partners and provided the tools for them to support 1,000 of their locals to boost their finances too. For us, this was kind of business as usual. Lockdowns forced us to re-imagine our delivery methods but we’ve been supporting people in poverty since we were established in 2006. There was a blindspot in commissioners’ thinking about what it takes to alleviate financial hardship. It was either all about debt and other crisis interventions or it was political. Money management was too everyday, something for us all to sort out ourselves as individuals. Maybe, with the pandemic, everyone felt vulnerable. ‘What would I do?’, they asked. And Clean Slate was suddenly working with social landlords, finance companies, national charities, local authorities, government departments and grant-makers everywhere. And without straying into crisis programmes or regulated financial advice, we helped people get on their feet. They not only felt able to cope but able to get on. Half the financial gains participants enjoyed were through finding work. These were often people who had felt hopeless. Now they recognised a future worth striving for. They felt in control. They knew the questions to ask and who to take them to. I wish I could say that with the cost-of-living crisis, we’ve only gone from strength to strength. Government procurement changes have allowed the fat cats back in, with employment support agencies with no experience in money guidance snatching the low-hanging fruit from the Department of Work and Pensions. Grant-makers have returned to their old priorities. Money management contracts are awarded to crisis programmes that patch people up and send them back out, potentially only to return again. Clean Slate had its chance to prove itself. And we totally did. The nomination for these awards might put a ratchet behind the thought leadership we’ve shown in what promoting financial resilience looks like. From a community perspective, it’s very much not business as usual. It is a profoundly impactful programme that starts from picking people up when they’ve been left behind. Whether that’s through our easy-read Quids in! magazines or through our money health-check and financial guidance programme, we’re meeting people halfway. Weirdly, that doesn’t happen often for people in hardship. Thankfully, we’re not directly up against some of the other giants standing for awards. Martin Lewis, Jack Monroe, Marcus Rashford and Richard Ratcliffe are all up for the Positive Impact in Society Award. And our friends at the Good Things Foundation (along with Virgin Media O2) are up for the Technology Award. So, wish us luck, but not so much for the awards. Instead, keep your fingers crossed that we can capitalise on this recognition and build new ways of working to lift thousands more out of hardship and hopefully out of poverty altogether. www.newstatesman.com/spotlight/2022/11/the-new-statesmans-change-makers Financial and emotional overwhelm, as well as systemic failures are likely to play a part.

Times are tight and it is worrying that those on the lowest income are not taking up financial help on offer. Prepayment meters are often used in households that have low incomes or are in debt and need flexibility managing their finances. By now, the first and second vouchers, each worth £66, should have been received. The vouchers originally had 90 days from the point of issue to be claimed. This has since been updated by the Minister for Climate, Graham Stuart, who said people can request a replacement from their supplier until 30th June 2023, if the vouchers expire before they are used. As a not-for-profit supporting those on a low income with money and related issues, Clean Slate is able to offer insights based on data from its services and feedback from staff and clients as well as national data. A Clean Slate investigation has revealed two key factors are at play: 1. Overwhelm and misunderstanding

2. Failure in systems and communication

Jeff Mitchell, Founder and Managing Director of Clean Slate and Quids in! said: “It’s good to see some added flexibility and we’ll be encouraging consumers to speak up if they’re worried about missing out. This is not easy for many people on low incomes. It is essential that those on old-style prepayment meters and most in need of support with energy bills are not disadvantaged further. “Complicated and inadequate systems fail to take into account how overwhelming things are and the lower levels of financial confidence that frequently come with managing life on a very low income.” Metro Mayor, Dan Norris, visited Cleans Slate’s drop-in service at Manvers Street Food Bank in Bath on 7th September, to find out about a new nine-week money guidance programme on offer to local residents.

Follow the Money is funded and managed by the West of England Combined Authority, led by Metro Mayor Dan Norris, and delivered by Clean Slate. The programme will enable 70 people to receive a personalised package of support, made up of one-to-one time with a Support Worker, options to join money and employment skills groups as well as paid experience and mentorship towards employment in the support sector. Similar projects have seen people make average financial gains of £1,000. As part of his visit, Mr Norris met Support Worker, Bella Washbourne and Peer Worker Mark Milsom who joined the programme and went on to receive mentorship and work experience via the Elements programme. Mr Norris said it was important to back programmes like Follow the Money at a time when so many households are grappling with rocketing bills and prices. He said: “The cost-of-living crisis is biting harder than ever, and people are desperately worried about ever-rising energy bills. I’m pleased to be able to give a helping hand to over 70 residents thanks to this £80,000 cash injection from the West of England Authority I lead.” Clean Slate Founder and Director, Jeff Mitchell, who hosted the Mayor, added: “We are delighted to receive funding from the West of England Combined Authority which will be targeted towards people who have been hit hardest by the cost-of-living crisis. It’s great to see leadership that recognises the cost-of-living emergency facing people in the West of England right now. Many of us are worried about the bills that will land in the Autumn and our Clean Slate Support Workers are ready to guide people through a comprehensive money health check and nine-week ‘Follow the Money’ programme with the aim to make significant financial gains.” For more information about Follow the Money, please click here. The West of England Combined Authority is working in partnership with Clean Slate to deliver the Community Support Fund. As part of the Combined Authority’s Recovery Fund, this fund supports residents most disproportionately affected by COVID, to achieve better economic outcomes. For more information on the Community Support Fund, please visit the website here. It’s Learning Disability Week 2022 - is your company missing out on this pool of untapped talent?23/6/2022

Opening Doors, a magazine originally released just before the pandemic hit, has been updated and re-launched to encourage employers in Bath and North East Somerset (B&NES) to think differently about recruiting people with special educational needs or disabilities (SEND). The publication lays out a sound business case for considering this group, from the plethora of organisations offering free support for employers, to the evidence around retention and loyalty often seen from those with SEND.

Opening Doors is written from an employer’s perspective by local community interest company Clean Slate, with the understanding that many employers may feel they do not know enough about working with those with SEND to make it viable. With expert input from Three Ways School, Leonard Cheshire and trailblazing employers like National Grid, the publication addresses common misconceptions and offers signposting for further support while also highlighting employers’ legal duties. Lucy Beattie, Fundraising, Marketing and Development Manager, at Three Ways School explains the thinking behind launching the magazine: “We wanted to bring stakeholders together to see how we could inspire employers about the talent we have available in our SEND jobseekers. We see long-term, unfilled vacancies across the whole B&NES area and we have candidates who are just not being given a chance. We know it seems like a challenge but we can provide the back-up to both employers and their staff.” Jeff Mitchell, Founder Director at Clean Slate, says: “Our message to employers is simple: If you’re screening out SEND jobseekers, you’re not only missing out on talent, you might also be in breach of the law. This guide is designed to inspire employers to think differently. Many solutions are straightforward and we’ve mapped out the steps in these pages.” Opening Doors features case studies from people with SEND working in the wider B&NES area, as well hearing from their employers who explain their journey to date. Many employers are seeing tangible benefits such as freeing up expert staff, better reflecting their customer base and reduced absenteeism. Opening Doors is available for free here. Anna Dietrich, the Regional Lead for the West of England at Clean Slate Training and Employment, is one of 15 leaders in Bath and North East Somerset to have been selected for a competitive learning programme and Match Trading grant of up to £15,000. The programme will help Anna to implement the innovative Elements project at Clean Slate, supporting people on a low income and those long-term unemployed to develop their life experience into skills an employer will value. This builds on pilot projects already underway at Clean Slate, which supports people on a low income to take control of their money, find work (or better work) and get online. Once people have addressed their immediate needs via Clean Slate’s one-to-one services, money skills and employment training, those who feel ready will be supported to understand and develop the skills that their own challenges and life experience have given them, with the option to develop towards work in the care and support sector which is currently facing a staffing crisis.

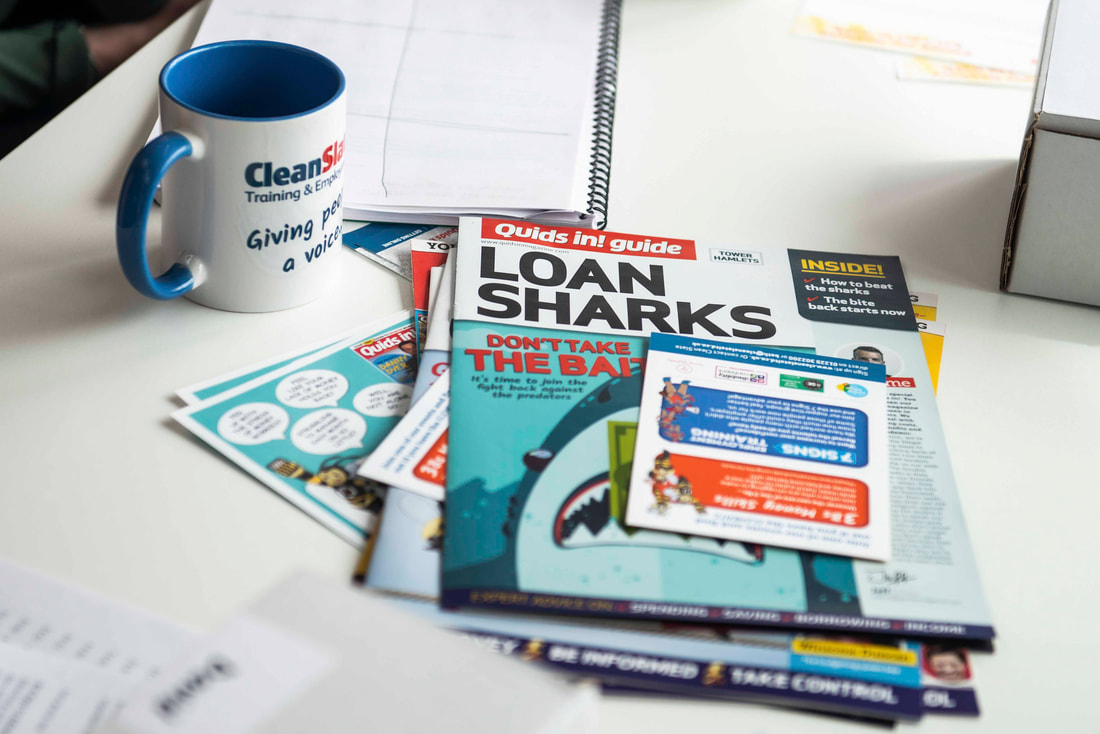

Anna has begun a four-month Accelerator learning programme with the School for Social Entrepreneurs, which supports people starting up and running social enterprises, charities, community business and environmental projects. Anna says: “I am excited to have been accepted onto the BaNES Social Entrepreneurs Programme. The programme, and Match Trading grant of up to £15,000 will help me develop the Elements programme at Clean Slate, so I can support more people in BaNES in 2022.” Bath and North East Somerset Social Entrepreneurs Programme is led by the School for Social Entrepreneurs (SSE) in partnership with 3SG. It is funded by the UK Government through the UK Community Renewal Fund, which is managed by the West of England Combined Authority within the Bath and North East Somerset region. Dirk Rohwedder, South West Director for School for Social Entrepreneurs, says: “We are delighted to welcome Anna Dietrich onto the Accelerator programme, where they’ll learn alongside other community leaders how to build a more resilient organisation and create greater social impact for the region. We are confident Anna has the leadership qualities and motivation to increase their impact on BaNES even further, which is why we have awarded her a highly coveted place.” As part of the programme, SSE has partnered with 3SG to provide free support through workshops and events until the end of June 2022. These will tackle subjects ranging from managing finances and fundraising to future planning and scaling up. They are open to all social enterprises, community businesses, charity and voluntary organisations in Bath and North East Somerset whether or not they’re on the programme and can be booked here: 3sg.org.uk/bsep  The England Illegal Money Lending Team (IMLT) has partnered with Quids in! to produce a free 8-page magazine, available in dual language Bengali-English, warning people about the dangers of borrowing money from loan sharks. The magazine is free of charge and primarily aimed at low income social tenants in Tower Hamlets. It is written in Quids in!’s accessible style and includes advice and information about how to spot the signs of illegal money lending and the support available for people affected by this crime. Quids in! Magazine is published by Clean Slate Training & Employment. The magazine provides advice for those who are struggling with their finances and may be at risk of being targeted by unscrupulous lenders. The guide has been funded by proceeds of crime money which has been confiscated from convicted loan sharks following successful prosecutions. A comic strip has also been designed to highlight the dangers of dealing with loan sharks, who are motivated by their own greed and will often trap victims into a vicious cycle of spiralling debts through threats, violence and intimidation. The story shows ‘Joan Clark the Loan Shark’ offering loans at extremely high interest rates with no credit checks. A loan shark is someone who lends money as a business without the correct permission from the Financial Conduct Authority (FCA). Loan sharks are unregulated money lenders that prey on vulnerable people and charge extortionate interest rates. They often resort to using harassment, intimidation, threats and violence to pressure people into paying back loans Signs to look out for when dealing with loan sharks:

Tony Quigley, Head of the England Illegal Money Lending Team, said: “Loan sharks prey on the vulnerable within our communities, with victims trapped in a cycle of debt with extortionate interest rates and the very real threat of violence and intimidation. “We want to make sure people are aware of where to go for support and encourage anyone who has fallen victim to loan sharks to report it as soon as possible on our confidential helpline or via live chat on our website. Lisa Woodman, Head of Business Development at Clean Slate Training & Employment CIC, said: “We were thrilled to receive funding from the England Illegal Money Lending Team to enable us to produce a Quids in! Guide about loan sharks, in dual language, English and Bengali. “Over 5000 copies have been printed and distributed to low income social tenants in Tower Hamlets, to raise awareness of the risks of borrowing money from an illegal lender, with a clear call to action for those who have been targeted. “We also partnered with social landlord Poplar Harca, who very much welcomed the opportunity to be able to distribute an accessible, trusted magazine, with clear messaging, to some of their most vulnerable tenants.” Residents who believe they may be involved with a loan shark or suspect that one is operating in their area can report it to the Illegal Money Lending Team by calling 0300 555 2222, emailing [email protected] or filling out an online form at stoploansharks.co.uk. Live Chat is available on the website between 9am and 5pm, Monday to Friday. You can read the Quids in! guide about loan sharks at: quidsinpro.com/quids-in-guides/loan-sharks-dont-take-the-bait/ |

© Clean Slate 2024. Clean Slate is a trading name of Clean Slate Training & Employment CIC. Registered office: 14 St James's Parade, Bath BA1 1UL

RSS Feed

RSS Feed